Last Updated on September 28, 2021 by Parentology

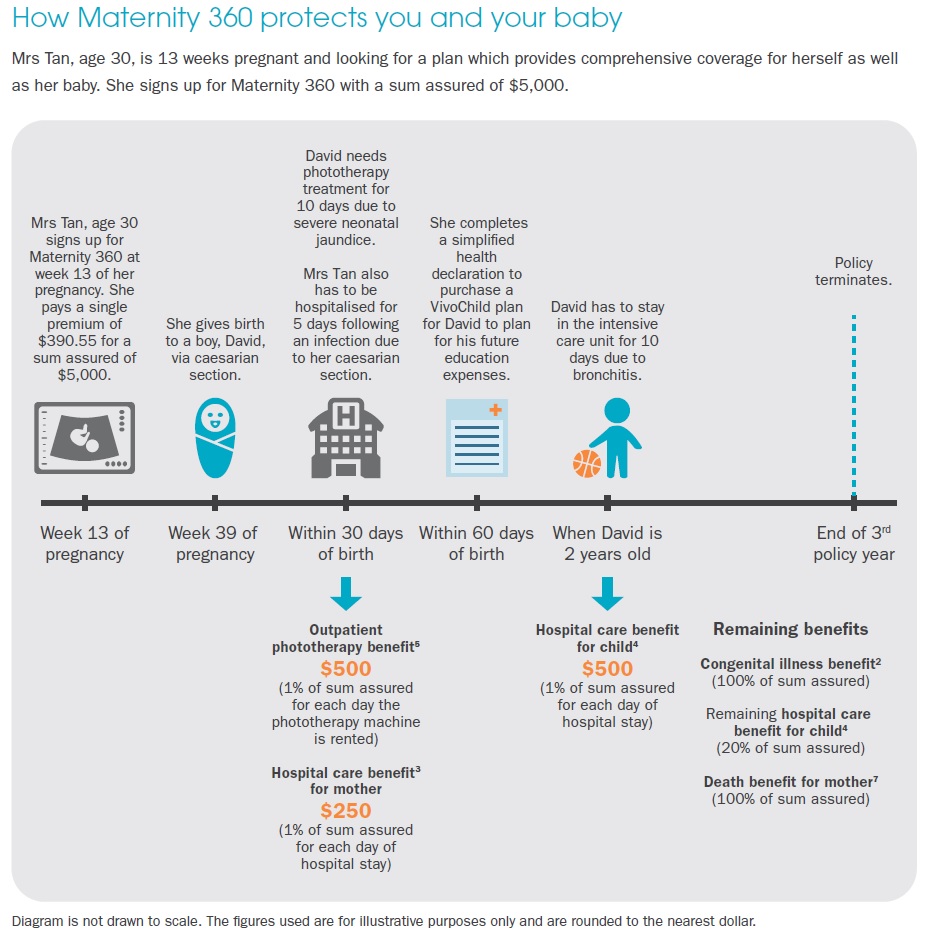

When it comes to Maternity Insurances, the market is filled with mostly bundled plans, either with a whole life, sometimes with an endowment but usually with an ILP (Investment-Linked Policy). NTUC Income however, came up with a stand-alone Maternity plan that stands on its own and is not bundled with any participating policy. Instead it gives you an option to add on an additional participating plan upon the birth of your child within 60 days.

Coverage includes death, 10 pregnancy complications and 23 congenital illnesses, daily hospital benefit and also outpatient treatment for newborns like phototherapy in the case of severe neonatal jaundice.

Different from traditional maternity plan which only covers mothers for 30 days after the baby is born, Income’s Maternity 360 covers for mother for 3 years after the baby is born.

NTUC Income Maternity 360 Product Features and Benefits at a Glance

NTUC Income’s Maternity 360 is a comprehensive and affordable protection plan for both the mother and newborn.

- Single Premium

- Maximum Sum Assured $10, 000

- Covers both Mother and Baby for up to 3 years

- It is a Term Plan with no cash value

- Hospitalisation Benefit For Both Mother OR Child – 1% of the sum insured daily up to 30days (Insured Details Below)

- Sum Assured paid out if child is born alive but diagnosed with congenital illnesses (Illnesses Details Below)

- Sum Assured paid out if mother is diagnosed with Pregnancy Complications (Complications Details Below)

- 1% of Sum Assured paid out if phototherapy machine is rented for child’s severe neonatal jaundice, up to 10 days.

- Total Sum Assured paid out upon death of child or mother during the policy (3 years)

- Option to take up a new affordable policy after the child is born, applicable within 60 days of child’s birth.

What We Like About The Plan

Low cost stand-alone plan – lowest in the market

Not bundled right from the start – Option to include Whole Life/ Endowment/ ILP after child is born

Simplified Application Benefit:

NTUC Income allows the insured mother to take up a new policy to insure the child within 60 days of birth based on a simplified health underwriting process, there are a few things to highlight.

The type of new policy that would be offered will be decided by the Insurer with certain conditions being met:

- Taking up the policy within 60 days

- Insured mother can buy more than one plan, but the total coverage for Death, Total and Permanent Disability as well as Critical Illness for Advance stage must not be over $150, 000.

Also, parents can choose to get endowment, whole life plans as well as ILPs under this.

The plans available are of course subjected to changes and if there are other riders/ policies that are not under the simplified benefits, there will be medical underwriting.

Able To Get It Early Into Pregnancy:

Competitive and low premiums aside, expectant mothers can consider this maternity plan at the 13th week of pregnancy! Making this one of the few maternity plans that accepts after the first trimester. The entry age for mothers are between 17 and 44 years of age. The eligible pregnancy period starts from 13th week to the 35th week of pregnancy to buy Maternity 360.

4. Able To Get It Early Into Pregnancy – Competitive and low premiums aside, expectant mothers can consider this maternity plan at the 13th week of pregnancy! Making this one of the few maternity plans that accepts after the first trimester. The entry age for mothers are between 17 and 44 years of age. The eligible pregnancy period starts from 13th week to the 35th week of pregnancy to buy Maternity 360.

What We Don’t Like About The Plan

Low Maximum Sum Assured of $10, 000. Not available for those that want more than $10, 000.

Insured Events in Maternity 360

Maternity 360 provides financial protection against congenital illnesses, pregnancy complications, and death. The policy covers 10 pregnancy complications and 23 congenital illnesses. You and your newborn will also receive hospitalization care benefits on a daily basis.

Insured Events for the Mother

10 types of pregnancy complications covered

| Abruptio placentae |

| Acute fatty liver of pregnancy |

| Amniotic fluid embolism |

| Choriocarcinoma and malignant hydatidiform mole |

| Disseminated intravascular coagulation |

| Ectopic pregnancy |

| Placenta increta or percreta |

| Postpartum haemorrhage requiring hysterectomy |

| Pre- eclampsia or eclampsia |

| Still birth |

| DOB

01-Feb-91 |

NTUC Income | NTUC Income

Gro Power Saver |

| Sum Assured | $25,000 (min) | $30,000.00 |

| Premium Term | 3 Year | 3 Year |

| Policy Term | 10 Years | 10 Years |

| END OF POLICY YEAR / AGE |

Based on 4.25% | Based on 4.25% |

| Surrender Value @ Year 10 | $32,511.00 | $39,013.00 |

| Annual Premium | $8,333.30 | $10,000.00 |

Hospital Care Benefits for the Mother

| Inpatient psychiatric treatment |

| Post-natal anaemia |

| Puerperal pyrexia |

| Pulmonary embolism |

| Repair of 4th degree perineal tear |

| Septic pelvic thrombophlebitis |

| Surgical site infection following caesarian section |

| Uterine infection or transfusion due to retained placenta following childbirth |

Insured Events for the Child

23 types of congenital illnesses covered

| Absence of two limbs | Anal atresia |

| Atrial septal defect | Biliary atresia |

| Cerebral palsy | Cleft lip and cleft palate |

| Club foot | Congenital blindness |

| Congenital cataract | Congenital deafness |

| Congenital diaphragmatic hernia | Congenital hypertrophic pyloric stenosis |

| Development dysplasia of the hip | Down’s syndrome |

| Infantile hydrocephalus | Patent ductus arteriosus |

| Retinopathy of prematurity | Spina bifida |

| Tetralogy of fallot | Trancheo-esophageal fistula or esophageal atresia |

| Transposition of the great vessels | Truncus arteriosus |

| Ventricular septal defect |

Hospital Care Benefits for the Child

| Bronchitis (including other lower respiratory tract infection) |

| Dengue haemorrhagic fever |

| Hand, foot and mouth disease |

| Incubation immediately after birth for more than 3 consecutive |

| days |

| Phototherapy or blood transfusion for severe neonatal jaundice |

| Pneumonia |

| Premature birth |

How It Works

Conclusion

NTUC Income’s Maternity 360 is a stand-alone maternity plan that pays out accordingly:

- The benefits of pregnancy complications and congenital illness benefits are payable once.

- The benefits of hospitalization for both mother and child takes place up to 30 days accordingly.

It is also one of the cheapest maternity plan in the market. However, the maximum sum assured of $10, 000 may be too low for some. We hope this article has provided value in your choosing of maternity plan for your upcoming little one! All Maternity Plans have their pros and cons and we strongly recommend that you consider your options wisely.

To do that, let our experienced advisors help you find the most suitable plan!

Fill in the form below and our friendly licensed FA advisor will get in touch with you based on your needs.

No obligations, no hidden fees. All advice are of no charges.